An Example: Car Accident

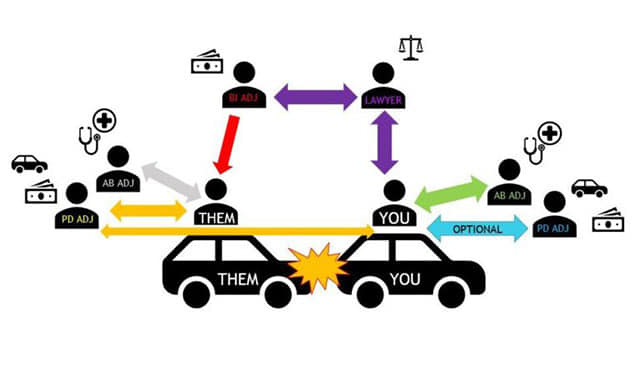

Imagine a standard car accident claim. You are injured in an accident caused by another driver. Below, is a simplified image depicting a straightforward rear-ending collision, as an example.

Seems simple enough, right? However, there are many people involved in even the most straight-forward car accident claim. For example:

A car accident can be overwhelming on its own, particularly if someone has been injured or hurt. The various parties involved can add to this sense of confusion. Time after time we hear from people who are overwhelmed and confused by the sheer number of different adjusters and other individuals involved in a claim.

Who is this “PD” adjuster? Why is this person called a “BI” adjuster calling? How are they different from the other person whose title is “AB” adjuster? Who do I talk to about getting more physio treatments approved?

This is only the tip of the iceberg. The whole scenario can be much more confusing when both drivers involved in the collision have policies of insurance with the same insurance company, or if one party does not have insurance, or if there are injured passengers.

That is why we have drafted this blog – to help you sort through the complex web of people shown above. Below, we break down the different parties and adjusters involved in a collision and explain what each one’s role is.

Your insurance company

Let’s start off with your insurance company.

After you’ve been in an accident, you will want to report the collision to your insurance company right away, as there are time limits that can affect your ability to open a car accident claim and access coverage. Learn more about what you need to remember to do right after a collision.

Before we dive into the different adjusters that your insurance company will assign to your file, let’s begin by clarifying who “your insurance company” is, because it is not always straightforward.

If you are both the owner of the vehicle and the driver of the vehicle at the time of the accident, then who “your insurance company” is should be straightforward: it is the company that you have purchased a policy of insurance from. If you are the driver of someone else’s vehicle, then (in most cases) “your insurance company” would be the company that the owner of the vehicle purchased insurance from. If you are the passenger in a vehicle, “your insurance company” would (in most cases) be the company that the owner of the vehicle purchased insurance from.

Please note that the above are simplified examples. There may be other factors that complicate whose insurance will cover you and be considered as “your insurance company” for the purposes of your car accident claim.

Learn more about your insurance policy’s Section B coverage.

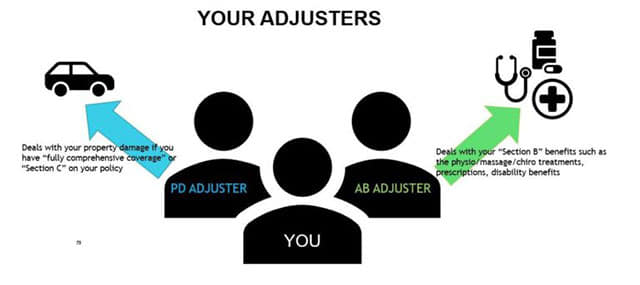

Your adjusters

When you call your insurance company to report an accident, they will most likely open a claim. Depending on what you report to them and the coverage that you have under your insurance policy, your claim may have up to 2 adjusters assigned to it: a Property Damage (or “PD adjuster”) and/or an Accident Benefits (or “AB adjuster”). Each of these adjusters serves a different role, which we outline briefly below.

Throughout the lifetime of your file, you will be in contact with the adjuster(s) from your insurance company, as they approve repairs to your vehicle, and treatments, disability payments, and other coverage, as applicable, to help you recover from your injuries.

PD Adjuster:

- deals with the property damage aspect of the claim (damage to your car, etc)

- may not be applicable if you or the owner of the vehicle have not purchased “fully comprehensive coverage” or Section C coverage as part of the insurance policy

AB Adjuster:

- deals with damage to your person including physical and psychological injuries, and approves coverage for treatments, prescription medication, ambulance bills, disability benefits etc

- usually an insurance company will not assign an AB adjuster unless and until you indicate to them that you have been injured

- keep in mind that there are timelines for reporting an injury in order to get coverage from your insurance company

- this is why it is important to report an injury, even if it seems like it might just be some neck or back pain, as soon as possible after the accident

Tip: Take note of your claim number, as it is their internal reference number for your file, and refer to it when speaking to or emailing your adjuster(s). Your specific adjuster may change over the lifetime of your file, but the claim number will remain constant.

Their insurance company

Let’s move on to their insurance company.

Before we dive into the different adjusters that their insurance company will assign to your file, let’s begin by clarifying who “their insurance company” is, because it is not always straightforward.

If the other driver involved in the collision is both the owner of the vehicle and the driver of the vehicle at the time of the accident, then who “their insurance company” is should be straightforward: it is the company that they have purchased a policy of insurance from. If they are the driver of someone else’s vehicle, then (in most cases) “their insurance company” would be the company that the owner of the vehicle purchased insurance from.

If you are the passenger in a vehicle and the driver of the vehicle that you are in is at fault in the accident, “their insurance company” would (in most cases) be the company that the owner of the vehicle purchased insurance from. Please note that in this situation, the same insurance company would be both “your insurance company” and “their insurance company”. In this type of situation, the passenger’s file would be assigned two sets of adjusters: “your adjusters” (PD/AB as described above, and as applicable), and “the other side’s adjusters” (PD/BI as described below, and as applicable).

Please note that the above are simplified examples. There may be other factors that complicate whose insurance will be considered as “their insurance company” for the purposes of your car accident claim. Claims can quickly become more complex where the other driver or vehicle owner did not have insurance, or the vehicle was stolen, for example.

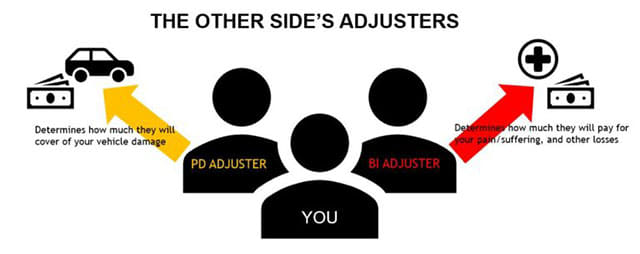

The Other Side’s Adjusters

Once the accident is reported to their insurance company, they will most likely open a claim. They may then try to follow up with the other vehicles and individuals involved to try to determine how the accident happened, who is at fault, and if anyone has been injured. Depending on the facts of the matter, your car accident claim file with them may have up to 2 adjusters assigned to it: a Property Damage (or “PD adjuster”) and/or a Bodily Injury (or “BI adjuster”). Each of these adjusters serves a different role, which we outline briefly below.

PD Adjuster:

- deals with the property damage aspect of the claim (damage to your car, etc)

BI Adjuster:

- deals with damage to your person including physical and psychological injuries by assessing how much they are willing to compensate you for the injuries and losses that you have suffered, by way of a settlement

- if you have retained a lawyer, your lawyer will deal with the BI adjuster, providing them with the evidence to prove your injuries and negotiating with them on your behalf to get you just compensation

- after you have retained a lawyer, the BI adjuster will no longer deal with you, and should deal exclusively with your lawyer

Still confused?

Still struggling to figure out who all the adjusters are with respect to your accident? A personal injury lawyer can help you to navigate this process and get just compensation. At Moustarah & Company, our experienced personal injury lawyers can assess the facts and your situation, provide you with an outline of your options, and help you navigate your personal injury claim. Call us today to book a free initial consultation.

The information provided on this website does not constitute legal advice and should not be construed as such. Moustarah & Company does not guarantee that this information is accurate or up to date. As a result, should you require legal advice, please contact a lawyer.